FamPay is a wonderful app that makes your transactions very easy and smooth. If you want to pay bills, split expenses, or track how much you’re spending, this app has everything. It’s an application that makes you fully in control of your transactions.

With enhanced security measures, all orders are processed through a protected server, keeping your personal information confidential and unreachable to third parties. Do you wonder how this one works? We will explore the entire set of what needs to know in this regard from FamPay through this write-up and guide how it happens quite smoothly.

Digital payments become a phenomenon to reach everywhere be it from any local vendor to a large mall. UPI has transformed people’s transaction mode, with most people in preference going completely cashless, hence, growing with this wave of trends were the companies pouring into the field of digital payment. FamPay is one among them. FamPay and Its Functions Let’s see what they do before that.

What is FamPay?

An application which sets an example, evolving in the developing world in 2019 by Kush Taneja and Sambhav Jain. Backed by investors such as Y Combinator, Sequoia India, and angel investors like Neeraj Arora of WhatsApp fame, the company could establish its mark with a $5 million funding within its initial days.

FamPay is a very convenient platform for easy money transfers, especially between families and friends who are geographically separated. It provides an easy and fast way to transfer money without hassle, allowing users to send funds with just a few clicks. Moreover, FamPay offers powerful features such as budget creation and spending limits to help users control their finances better.

With an IDFC FIRST Bank – FamPay account, a user can perform the following things:

- Scan for UPI QR codes to pay.

- Peer-to-peer (P2P) transactions with all the contacts listed on FamPay.

- Online as well as in-store purchasing through the prepaid card of the bank.

How to Download FamPay?

The way FamPay functions begins with understanding how to download the app. Follow these steps for easy instructions:

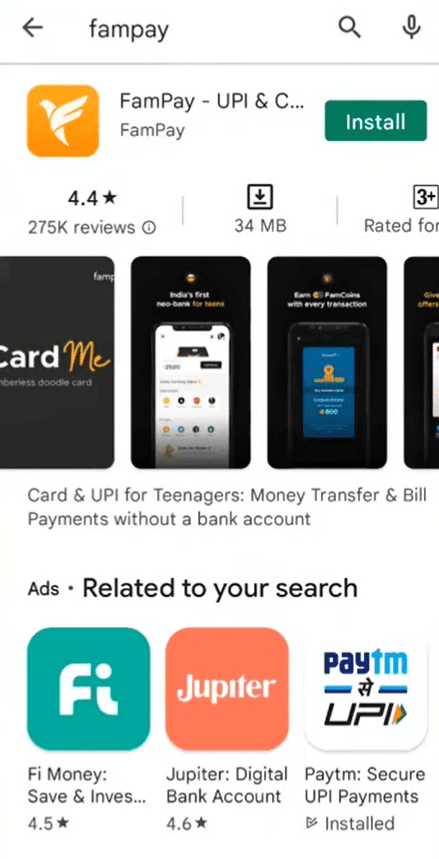

- Open Google Play Store on Android devices or the App Store on iPhones.

- Search for the “FamPay” app.

- App search interface illustration

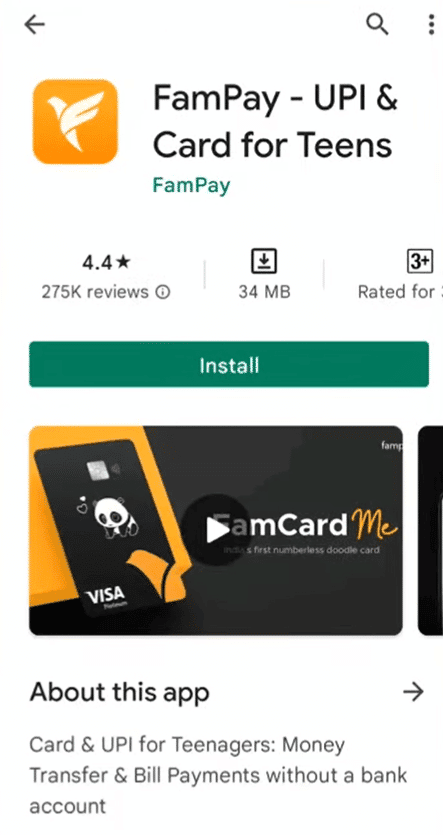

- Select the FamPay app from the results and tap “Download.”

- Once the download is done, install and open the app.

- FamPay app in the Play Store illustration

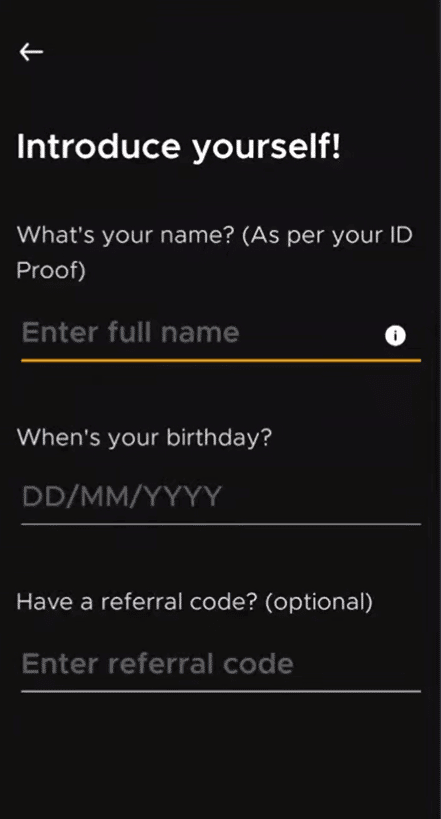

- Sign up using your phone number.

- After verifying your phone number, proceed to create your account.

- Complete the setup by filling in your personal details.

- You are now ready to explore the features of FamPay!

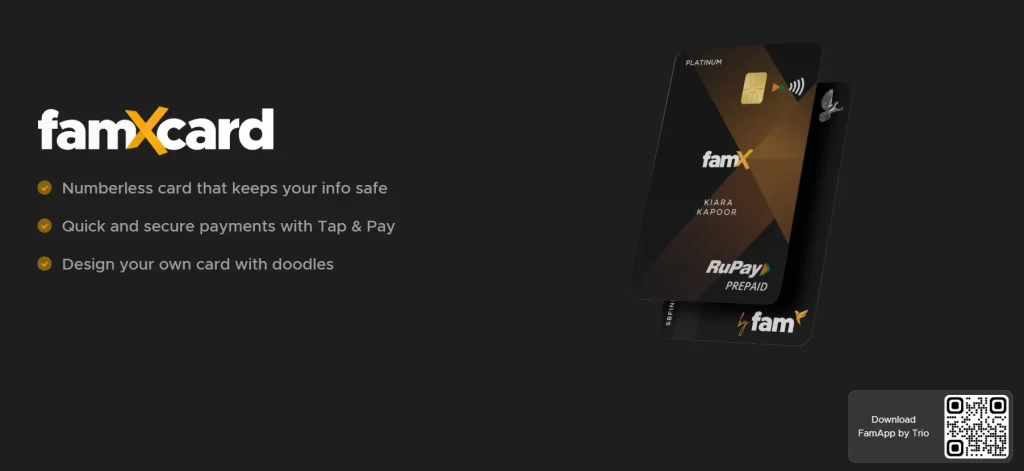

Introducing FamCard

Card usage is on a rise with the increased cashless transactions, especially in the pandemic era. Now, there’s a unique app called FamPay, created specifically for teenagers below 18 years of age. The app allows easy payment and collection without borrowing cash or cards from their parents. A safe and easy means of money management will be guaranteed with the use of the FamCard.

How Does the FamCard Work?

FamCard is a credit-card-sized device that can be used both online and offline, providing an easy and secure means for teenagers to manage their money. It supports UPI, P2P, and FamPay payment options. The parent can transfer money directly from their bank account to the app. Teens can use these funds to make purchases just like they would with debit cards today.

Enjoy the benefits of FamCard only after you sign up for the FamPay account. After you open your account with the app, through which you can access an online virtual card to support online transactions and purchases. And if you want to pay offline merchants such as POS terminals and ECOM platforms, by using RuPay cards, you may order a physical FamCard.

The best feature of the FamCard is that it tracks and controls all the transactions made by the children, hence preventing wasteful spending.

You easily access the card from the application home screen, and all that you have to do is swipe down to display card information required for web-based transactions. To make any purchase using your card, all you need to do is click the card number for it to copy and paste on the payment channel where you’d like to pay. The FamCard is well developed with secure operations, ensuring reliability while making transactions online.

More Resources:

Successful Entrepreneurs in India 2025

Young Entrepreneurs in India

MBA Chai Wala Net Worth 2024

Vivek Bindra Net Worth 2024

Aman Gupta Net Worth 2024

Emiway Bantai’s Net Worth 2024

Archana Puran Singh Net Worth 2024

What is a FamPool Account?

Now, having discussed FamPay, let us move on to the FamPool account. It is a shared sub-wallet for the family by IDFC First Bank, which offers an excellent way to collectively manage and track finances.

That’s how it works:

With any adult being the account owner, money can be added into the FamPool account from whichever source desired- net banking, a debit card, or UPI.

One adult defines a family group in the FamPool app. A KYC verification process is required to establish them as account owners before an account can be created.

Once the owner account is created, invitations are given to the children, who need to accept these invitations first to start forming their profile in FamPool.

A FamPool account authorizes the issuance of two add-on cards, known as supplementary cards, for family members. It enables the family members to spend from the FamPool balance for various transactions and purchases easily. It is even more useful that the family members can see all transactions made with the FamPool account and hence transparency in full and proper financial planning can be done.

Is FamPay Approved by RBI?

So, we learned about the operations of FamPay and FamPool accounts, but is FamPay safe and approved by the Reserve Bank of India?

FamPay co-founder Kush Taneja stated that the app is very much with all licenses the RBI desired. That keeps FamPay providing a wide array of financial services while in total regulatory compliance. FamPay also makes Know Your Customer (KYC) very simple and convenient because the users can complete their KYC in-app online. Furthermore, FamPay has collaborated with IDFC First Bank and RuPay to provide seamless and efficient financial services.

Other Resources:

AdSense Plugins for WordPress 2025

WordPress AntiSpam Plugins 2025

WordPress Form Builder Plugins 2025

Google Analytics Plugins For WordPress 2025

WordPress Advertising Management Plugins 2025

WordPress Cache Plugins to Improve Speed and Core Web Vitals 2025

WordPress Backup Plugins For Automated Backup 2025

Best WordPress Membership Plugins 2025 (Free and Paid)

WordPress internal linking plugins to improve URL Rating for SEO 2025

Best WordPress Maintenance Mode Plugins 2025

Best WordPress Affiliate Plugins 2025

SEO Plugins for WordPress in 2025

Best WordPress FAQ Plugins 2025 (Free and Paid)

Best Comparison and Pricing Tables WordPress Plugins 2025

Best WordPress Newsletter Plugins 2025

Best Contact Form Plugins for WordPress 2025

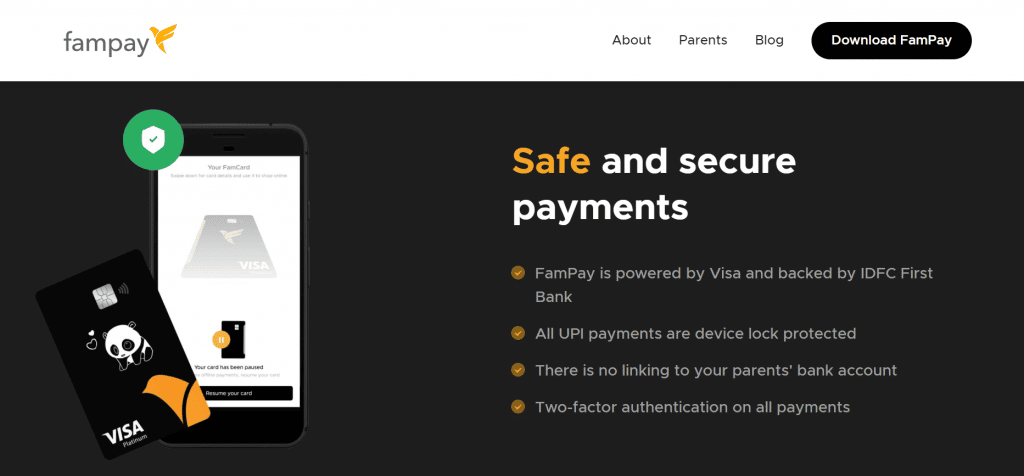

Is FamPay Safe?

FamPay is entirely safe for teenagers. Here is how the app stands apart from the rest:

- Total Security: FamPay deals with transaction security through an unhackable end-to-end encrypted security system.

- You have partnered with a bank: FamPay is in partnership with IDFC First Bank. This adds credibility and extra banking security along with high customer support.

- Load It Faster: FamPay accounts are separate from a traditional bank account; thus, you have to add money to your account before sending it.

- Zero Hidden Fees and No Minimum Balance: FamPay is upfront about this from the very start.

- FamCard is made 100% safe: There is no card number on the actual card; the app keeps the details encrypted.

- Parental Control: The parent is allowed to track every transaction their child conducts.

- Device Lock Security: It is mandatory, really. FamPay requires device authentication for every transaction done online and offline.

- One Time PIN: Flash Pin-One time flash PIN for each transaction.

- Card Control: The users can block and unblock their FamCard on the go and at no cost.

- Fast Resolutions: The variations reported by users get solved smoothly and quickly by FamPay’s reconciliation team.

FamPay is creating financial independence for the teen under parents’ security.

Future Plans for FamPay

The company says to YourStory that it plans to undertake the economical app, built to help teens spot brands that focus on issues associated with teens, such as pure skincare, a mental wellness platform for exam stress management, and ed-tech to improve learning outcomes.

Besides all this, FamPay has plans in mind to gamify financial concepts such as investing, fixed deposits, and more. The tentative roadmap offers a newly conceived way of sending beautiful positive vibes around the thought of financial independence into the very minds of users.

According to Zion Market Research, the global neobank market is expected to explode at an unbelievably high growth rate of 46.5%. That would propel the market size from $18.6 billion in 2019 to around $394.6 billion by the year 2026. In this fast-paced environment of Fintech, many of the new-age startups are starting to pivot to provide full-stack of financial services to their clientele.

FamPay stands in good stead as its first-mover advantage provides it more opportunity to grow further down the road in the netbanking segment for teens and establish itself as a leader in shaping the financial future of generations to come.

Conclusion

We sincerely hope that you had a wonderful experience while learning how FamPay functions. FamPay is the revolutionary startup in the finance space that has transformed the way teenagers manage their money and pay. The secure, simple, and innovative platform guarantees seamless and hassle-free transactions for both teenagers and their families.

Get on board for free and see FamPay’s ease at your next purchase. From rapid payments to budgeting and keeping parents’ peace of mind while buying online, FamPay has it all. Take the plunge and check it out for smarter finance management!

FAQs About FamPay App

1. What is FamPay?

FamPay is a mobile application for teenagers that empowers them to make safe payments, keep spending records, and manage finances under parental supervision.

2. Is FamPay safe for teens?

Yes! FamPay is safely secured due to end-to-end encryption powered by IDFC First Bank for secure fund transfers and many other features like device lock, Flash PINs, and parental controls.

3. How do you open a Fam Pay account?

You can access FamPay on your mobile device by downloading the application from Play Store or App Store, registering with your mobile number, and verifying the account by completing KYC.

4. What is FamCard?

FamCard is a prepaid smart card that links to the FamPay app. It allows online and offline transactions by teens and helps track their spending while the parents can regulate it.

5. Do parents have the ability to monitor their children’s spending?

Yes, parents can review all transactions made by the children on the FamPay app and find solace that they are instilling financial literacy in its younger minds.

6. How does the FamPool account function?

The FamPool account is a family joint account where parents can fund and spend amounts for their children who carry additional cards. All transactions are visible to all family members.

7. Can I use FamPay to shop online?

Yes, a FamCard linked to a FamPay account can be used in online shopping as well as at any retailer that accepts RuPay cards.

8. Is FamPay RBI approved?

Yes, it is indeed an RBI-approved and RBI-compliant platform for delivering financial services according to required stipulations.

> My Response is on my own site

> Image Sharing Sites

> Profile Submission Sites

> Edu Sites for Backlinks

> Ping Submission Sites

> PDF Submission Sites

> Social Bookmarking Sites

More Resources:

> What is breadcrumb navigation for SEO?

> Mobile SEO Mistakes

> How do we improve page speed- The Complete Guide

> SEO Myths about website optimization